KENNAMETAL (KMT)·Q2 2026 Earnings Summary

Kennametal Surges on 27% EPS Beat as Tungsten Pricing Drives Blowout Quarter

February 4, 2026 · by Fintool AI Agent

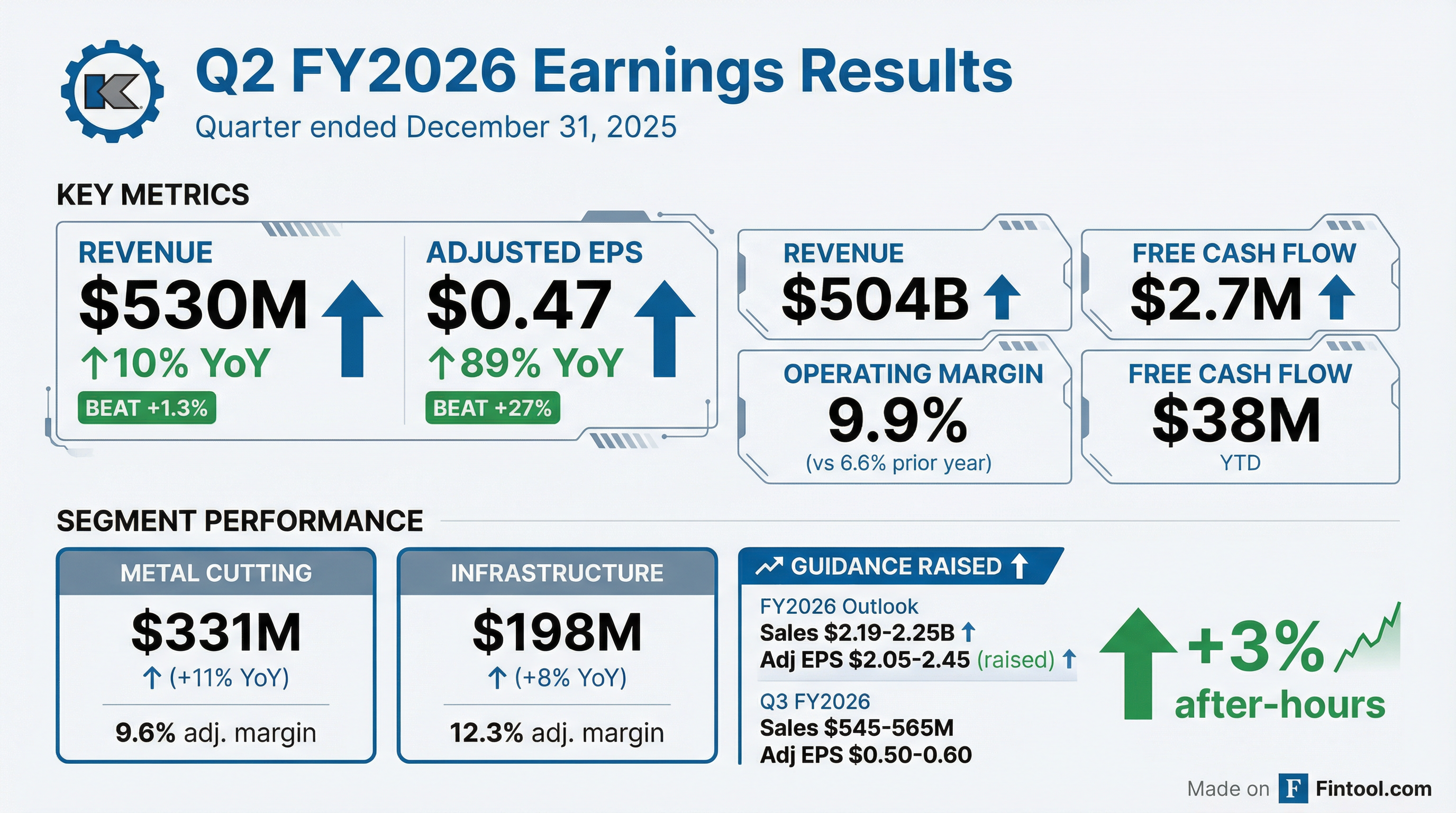

Kennametal (NYSE: KMT) delivered a standout Q2 FY2026, crushing analyst estimates with adjusted EPS of $0.47 versus the $0.37 consensus—a 27% beat—while revenues of $530 million exceeded expectations by 1.3%. The industrial tooling company also raised its full-year outlook substantially, sending shares up 3% in after-hours trading to $36.65.

The quarter's strength was driven by favorable tungsten pricing dynamics within the Infrastructure segment, incremental restructuring savings of ~$8 million, and organic sales growth of 10% year-over-year.

Did Kennametal Beat Earnings?

Yes, decisively. Kennametal beat on both the top and bottom line:

The EPS beat was Kennametal's largest in the past two years. The outperformance was attributed to:

- Tungsten pricing tailwind (~$17M favorable timing vs. raw material costs)

- Restructuring savings (~$8M incremental year-over-year)

- Pricing and tariff surcharges in Metal Cutting segment

- Volume growth from buy-ahead activity ahead of tungsten price increases

CEO Sanjay Chowbey noted: "We are pleased with our second quarter results, which exceeded the high end of our sales and adjusted EPS Outlook, driven by volume in the quarter, largely from buy-ahead in response to the tungsten pricing environment and modest improvement in certain end markets."

What Did Management Guide?

Kennametal raised its full-year outlook materially—a significant positive signal given the challenging industrial backdrop.

Prior FY2026 guidance was $1.35–$1.65 adjusted EPS, making this a 48–71% increase in the midpoint range.

The guidance raise reflects:

- Continued favorable tungsten pricing dynamics

- Higher production volumes expected to sustain

- Additional restructuring benefits flowing through

How Did the Stock React?

KMT shares traded up approximately 3% in after-hours to $36.65 from the $35.56 prior close.

The stock has been on a tear, trading near its 52-week high of $36.34 (which was set during today's regular session). For context, the 52-week low was $17.30—meaning KMT has more than doubled from its lows.

What Changed From Last Quarter?

Several key dynamics shifted from Q1 FY2026:

*Values retrieved from S&P Global

The biggest delta was the tungsten pricing tailwind that emerged in Q2—management quantified this as approximately $17 million of favorable timing between pricing and raw material costs within the Infrastructure segment.

Segment Performance Deep Dive

Metal Cutting (63% of sales)

Metal Cutting benefited from:

- Pricing and tariff surcharges

- Higher sales and production volumes

- ~$6M incremental restructuring savings

Infrastructure (37% of sales)

Infrastructure was the star performer, driven almost entirely by the ~$17 million favorable timing of pricing vs. raw material costs.

End Market Commentary

Management provided updated views on key end markets:

Key end market insights:

- Transportation: IHS estimates improved with Asia-Pacific volumes up, EMEA still down but better, Americas slightly negative but flat overall

- Aerospace & Defense: OEM build rates continue improving; Boeing strike absence in prior year was a tailwind (+19-23% growth)

- General Engineering: US ISM PMI above 50 for the first time in 12 months—a positive signal, though management is waiting for it to translate to real orders

Historical Earnings Trends

Kennametal's quarterly performance over the past 8 quarters:

*Values retrieved from S&P Global

The company has now beaten estimates in 3 of the last 4 quarters after a challenging stretch in early FY2025.

Cash Flow and Capital Allocation

Cash flow was lower year-over-year due to increased inventory build (customers buying ahead of tungsten price increases). Management expects FOCF to reach approximately 60% of adjusted net income for the full year.

Dividend: Kennametal declared a quarterly dividend of $0.20 per share, payable February 24, 2026.

Power Generation: A Key Growth Catalyst

Management spotlighted the rising global demand for electricity as a major growth opportunity. This "source-to-generation" market represented approximately 17% of FY2025 sales, with attractive growth tailwinds.

Key drivers include:

- AI Data Centers: Could represent 17% of US power demand by 2030

- EV Adoption: EVs and hybrids growing at strong double-digit CAGRs in the Americas

- Energy Mix Diversification: By 2030, incremental supply expected from 45% natural gas, 35% solar, 20% wind

CEO Sanjay Chowbey emphasized: "Kennametal is not just participating in the energy transition, we are powering it."

Q&A Highlights

Tungsten Supply and Sourcing Strategy

Analyst Steve Volkmann (Jefferies) pressed on tungsten supply concerns given prices are up 33% year-to-date. Management provided reassurance:

- Diversified sourcing: Uses recycled materials, a facility in Bolivia, and multiple suppliers with long-term agreements

- No China dependence: Operations outside China do not depend on Chinese material

- Supply outlook: Additional mining activity and government involvement in projects suggest ample supply coming online longer-term

- Product efficiency: R&D focused on using tungsten more efficiently (mixing with steel, optimizing product design)

Volume Trends Adjusted for Buy-Ahead

Julian Mitchell (Barclays) sought clarity on underlying volume trends. Management explained:

- Total buy-ahead in Q2: $13 million ($10M Metal Cutting + $3M Infrastructure)

- Adjusted Q2 volume: Flat (vs. reported +3% organic)

- Adjusted Q3 volume: +1% (vs. reported -2% at midpoint)

- Trend: Volume improving sequentially—Q1 was -1%, Q2 flat (adjusted), Q3 expected +1% (adjusted)

Pricing Dynamics

On pricing lag in Metal Cutting, management noted:

- ~3 month lag for list price changes in Metal Cutting

- Goal is to stay competitive if tungsten prices eventually decline

- Tariff surcharges remain separate from permanent pricing—will be rolled back if tariffs decrease

FY2027 Preview

CFO Pat Watson provided early hints on fiscal 2027 tailwinds:

Incremental Margins

Management reiterated their target incremental margin on volume growth:

- Mid-40s% on volume (through-the-cycle)

- Metal Cutting has slightly higher incrementals than Infrastructure

- On pricing, the goal is to offset raw material cost increases (neutral contribution)

Key Risks and Concerns

Despite the strong quarter, management flagged several headwinds:

- Tariff exposure: Higher tariffs and trade barriers could pressure margins—though India tariff impact is minimal as Kennametal doesn't source much from India to US

- Tungsten timing reversal: The favorable pricing vs. raw material timing may normalize or reverse; management expects some benefit to carry into early FY27

- Macroeconomic uncertainty: Industrial demand remains uneven across end markets

- Inventory normalization: Customer buy-ahead activity (~$13M in Q2) may create future demand headwinds

- Ukraine/Middle East conflicts: Ongoing geopolitical risks to operations and supply chains

Forward Catalysts

Key events and milestones to watch:

The Barclays conference in two weeks may provide additional color on end-market trends and sustainability of tungsten pricing benefits.

The Bottom Line

Kennametal delivered a blowout Q2 FY2026 driven by favorable tungsten pricing dynamics, restructuring savings, and organic volume growth. The 27% EPS beat and substantial guidance raise signal management confidence in sustained margin improvement. While some tailwinds (particularly the tungsten timing benefit) may prove transitory, the underlying business improvement is evident in organic growth and restructuring execution.

Key takeaways:

- Beat: Revenue +1.3%, Adjusted EPS +27%

- Raised guidance: FY2026 EPS now $2.05-$2.45 (vs. prior $1.35-$1.65)

- Margins expanding: Both segments saw 350+ bps YoY margin improvement

- Stock reaction: +3% after-hours, near 52-week highs

Data sources: Company filings, S&P Global, Fintool analysis. Last updated: February 4, 2026.

View Full Q2 FY2026 8-K Filing | Read Earnings Call Transcript | Kennametal Company Page